Summary

- Trinity Capital Inc. is increasing its dividend by $0.01 per share per quarter, making it attractive for passive income investors seeking growth.

- The BDC covers its dividend with net investment income, with potential for continued dividend growth due to stable interest rates.

- Trinity Capital's stock is selling at a premium to net asset value, indicating investor confidence in the company's ability to maintain its dividend.

PM Images

Trinity Capital Inc. (NASDAQ:TRIN) is growing its dividend by $0.01 per share per quarter, which makes the business development company particularly attractive for passive income investors that value both a high dividend yield as well as prospects for growth in the underlying dividend.

The BDC covered its dividend with net investment in 1Q24 and I see ongoing potential for Trinity Capital to keep it up in terms of dividend growth in 2024, primarily because the central bank is not going to get aggressive lowering interest rates this year.

The BDC's stock is selling for a nice premium to net asset value, which indicates that passive income investors presently don't anticipate a dividend cut.

The risk/reward relationship looks compelling, though I think Trinity Capital is probably fully valued right now.

My Rating History

Despite the presence of net realized losses in Trinity Capital's fourth quarter, my stock classification for the business development company was Buy. The main justification for my stock classification can be found in the BDC covering its dividend with net investment income, which Trinity Capital again did in the first quarter.

I think that the odds are in favor of continued dividend growth, and the BDC is poised to profit from the central bank's plan to lower short-term interest rates only once in 2024.

Trinity Capital's Unique Portfolio Composition, Decline In Debt Yields

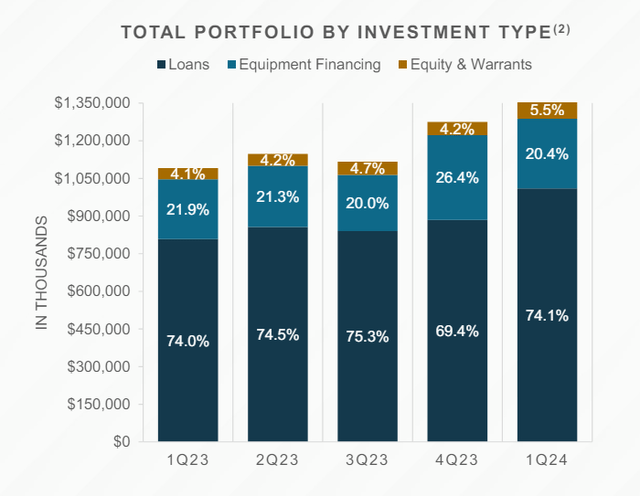

Trinity Capital's investment portfolio consists primarily of term loans and equipment financing deals with growth stage companies. The main source of income are terms loans, which accounted for more than 74% of assets as of the end of the first quarter. Equipment financing loans accounted for 20% of portfolio investments while Equity/Warrants, 4%, provide some total return upside for Trinity Capital in case one of its portfolio companies strikes a home-run.

The business development company's portfolio was valued at $1.36 billion as of March 31, 2024, reflecting a decrease of $88.7 million QoQ, primarily because of loan repayments.

Total Portfolio By Investment Type (Trinity Capital Inc)

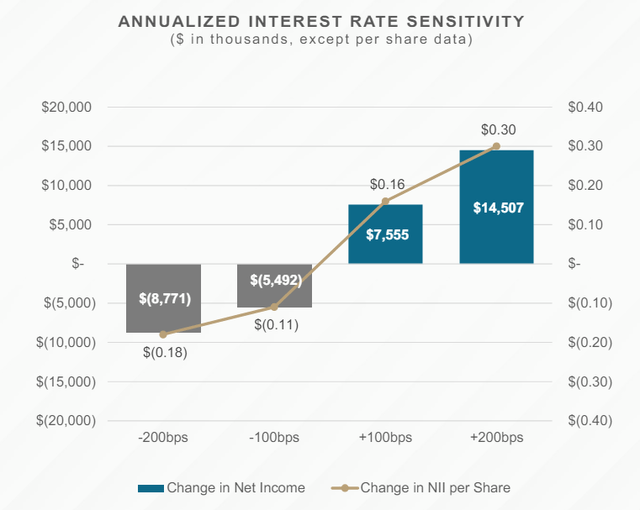

Trinity Capital owned 75.4% floating-rate debt investments in 1Q24 and had 25.8% floating-rate borrowings, which give the business development company substantial net positive exposure to persistently high short-term interest rates.

The central bank declared last week that it was only targeting one rate cut in 2024 which creates a favorable backdrop for those business development companies that are primarily running on floating-rate term loans, such as Trinity Capital.

Annualized Interest Rate Sensitivity (Trinity Capital Inc)

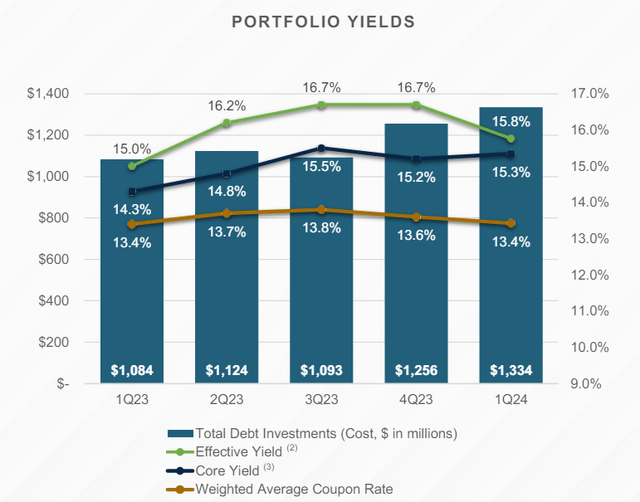

Trinity Capital's debt yields fell in the first quarter, primarily because the market anticipates a drop in interest rates, which diminishes the bargaining position of business development companies that hand out high-interest loans to their portfolio companies.

In 1Q24, Trinity Capital's effective portfolio yields slumped from 16.7% to 15.8% QoQ. I anticipate ongoing pressure on debt yields in the coming quarters, as the central bank is cautiously moving towards cutting interest rates for the first time this interest rate cycle.

With a rate cut probably getting implemented towards the end of the year, Trinity Capital might suffer ongoing pressure on its portfolio yields. With that being said, though, I don't see any elevated dividend risks for Trinity Capital as of right now.

Portfolio Yields (Trinity Capital Inc)

Dividend Growth And Pay-Out Ratio

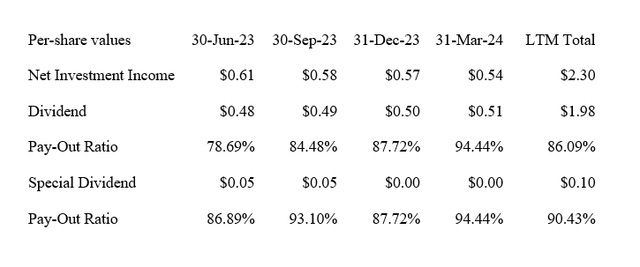

Trinity Capital continued to out-earn its dividend with net investment income in the first quarter, and that's despite the business development company raising its quarterly dividend by $0.01 per share per quarter (the BDC hiked its dividend by this amount for six straight quarters).

Trinity Capital earned $0.54 per share in net investment income in 1Q24, which translates into a dividend pay-out ratio of 94%. The dividend pay-out ratio increased steadily in the last year, up from 79% in 2Q24, due to a shrinking portfolio and falling NII, but the present dividend of $0.51 per share is well-covered by net investment income.

Dividend (Author Created Table Using BDC Information)

17% Premium To NAV

Trinity Capital is a business development company that I would classify as higher quality due to the fact that the BDC raises its dividend and consistently covered its dividend with net investment income in the last year.

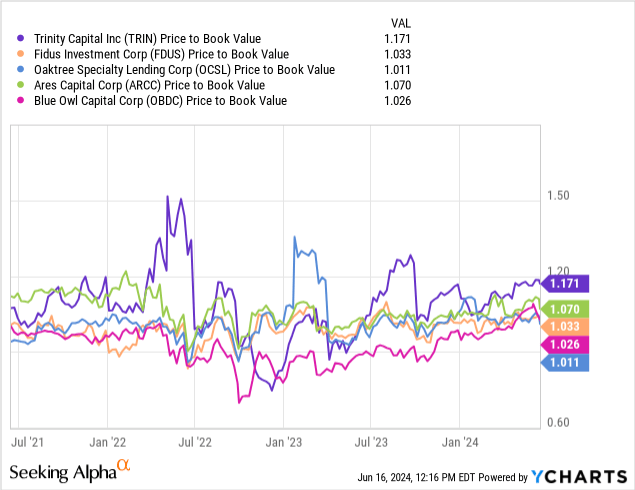

Furthermore, the BDC's stock is now selling for a 17% premium to net asset value, which shows that passive income investors value the combination of a high initial yield (presently 14%) and the potential for dividend growth.

The growing dividend particularly is an advantage that Trinity Capital has over business development companies like Ares Capital (ARCC) or Oaktree Specialty Lending Corp. (OCSL) which are not growing their dividend pay-outs. Trinity Capital rightfully has grown to a premium valuation over time as investors have started to chase those BDCs that deliver income growth.

Taking into account that the central bank is about to slowly ease the market into rate cuts in the latter half of the year, however, I don't see upside potential for Trinity Capital's stock. As a matter of fact, I think a 17% premium to NAV is about fair for Trinity Capital (implied intrinsic value $14.81).

What Risks Passive Income Investors Have To Consider

Trinity Capital, as I argued, still covers its dividend with net investment income, but the BDC's margin of safety as far as the dividend is concerned has narrowed in the last year primarily due to a drop in net investment income which in turn was related to a higher amount of repayments.

The floating-rate characteristic of Trinity Capital's portfolio works still in favor of the BDC, though I anticipate lower interest rates to be a headwind for its net investment income upside in 2024, and particularly in 2025.

My Conclusion

Trinity Capital's 14% yield, which seems high, is still not that risky, in my view. I arrive at this conclusion primarily because the business development company covered its dividend with net investment income (and produced excess dividend coverage in the amount of $0.03 per share in 1Q24) while the dividend went up $0.01 per share to $0.51 per share.

Though Trinity Capital's debt yields have taken a hit in the first quarter and the portfolio value declined due to repayments, the dividend pay-out is the more important metric that I think can sustain my earlier ‘Buy' stock classification.

The stock price, in my view, equals intrinsic value, but the 17% premium to net asset value also highlights that the market presently does not anticipate Trinity Capital to cut its dividend. Buy.